The Main Principles Of Pvm Accounting

The Main Principles Of Pvm Accounting

Blog Article

Indicators on Pvm Accounting You Need To Know

Table of ContentsGet This Report about Pvm AccountingSome Of Pvm AccountingThe 5-Second Trick For Pvm AccountingThe 30-Second Trick For Pvm AccountingThe Basic Principles Of Pvm Accounting Pvm Accounting Can Be Fun For Anyone

Guarantee that the accountancy process conforms with the legislation. Apply called for construction accountancy requirements and procedures to the recording and reporting of construction task.Interact with numerous funding firms (i.e. Title Business, Escrow Firm) relating to the pay application procedure and demands required for payment. Aid with executing and maintaining inner financial controls and treatments.

The above statements are planned to describe the general nature and level of work being performed by people appointed to this category. They are not to be taken as an exhaustive checklist of obligations, responsibilities, and abilities required. Personnel might be required to carry out duties outside of their normal duties once in a while, as required.

How Pvm Accounting can Save You Time, Stress, and Money.

You will certainly help sustain the Accel group to make sure distribution of effective on time, on budget, projects. Accel is seeking a Building Accountant for the Chicago Workplace. The Building and construction Accounting professional performs a selection of accounting, insurance conformity, and job administration. Functions both separately and within details departments to keep monetary records and make certain that all documents are kept current.

Principal duties include, yet are not restricted to, taking care of all accounting features of the business in a prompt and precise manner and supplying reports and routines to the firm's CPA Firm in the prep work of all monetary statements. Ensures that all accounting procedures and features are taken care of properly. Accountable for all monetary documents, pay-roll, banking and day-to-day operation of the bookkeeping function.

Prepares bi-weekly trial balance records. Works with Job Managers to prepare and upload all month-to-month invoices. Processes and problems all accounts payable and subcontractor repayments. Generates regular monthly wrap-ups for Workers Payment and General Liability insurance costs. Creates month-to-month Job Cost to Date records and dealing with PMs to fix up with Project Managers' allocate each project.

Getting The Pvm Accounting To Work

Proficiency in Sage 300 Construction and Property (previously Sage Timberline Workplace) and Procore building monitoring software a plus. https://www.wattpad.com/user/pvmaccount1ng. Should additionally be efficient in various other computer software application systems for the preparation of records, spread sheets and other accountancy analysis that might be required by management. construction accounting. Must possess solid business skills and ability to focus on

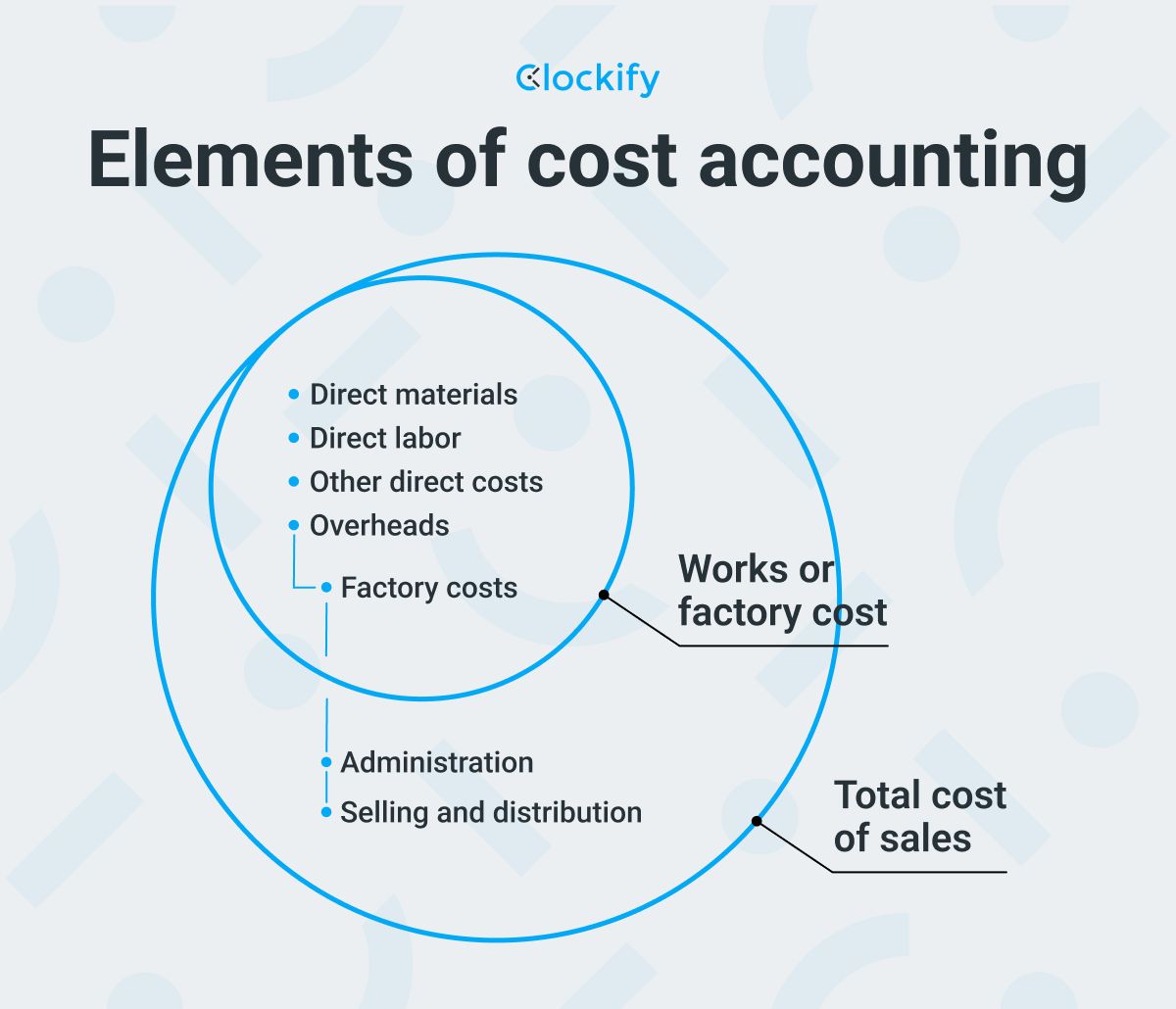

They are the monetary custodians who ensure that building projects continue to be on budget plan, conform with tax guidelines, and keep monetary transparency. Construction accounting professionals are not just number crunchers; they are calculated companions in the construction procedure. Their main role is to take care of the financial elements of building and construction jobs, making sure that sources are designated successfully and financial threats are minimized.

The 7-Second Trick For Pvm Accounting

By preserving a limited grasp on job financial resources, accounting professionals aid protect against overspending and financial obstacles. Budgeting is a foundation of effective building and construction tasks, and building and construction accountants are critical in this respect.

Navigating the complicated web of tax laws in the building and construction market can be difficult. Building and construction accounting professionals are skilled in these guidelines and make certain that the job abides by all tax obligation requirements. This includes handling pay-roll taxes, sales taxes, and any various other tax obligations certain to building. To excel in the function of a building accounting you can check here professional, people need a strong academic foundation in bookkeeping and financing.

Additionally, qualifications such as Cpa (CERTIFIED PUBLIC ACCOUNTANT) or Qualified Construction Industry Financial Professional (CCIFP) are extremely pertained to in the market. Working as an accountant in the construction industry features a special collection of obstacles. Building and construction projects commonly involve tight deadlines, changing policies, and unanticipated expenses. Accountants must adapt swiftly to these difficulties to maintain the task's financial wellness intact.

The smart Trick of Pvm Accounting That Nobody is Discussing

Professional certifications like CPA or CCIFP are additionally extremely advised to demonstrate competence in construction audit. Ans: Building accountants produce and monitor spending plans, determining cost-saving possibilities and guaranteeing that the project remains within budget plan. They additionally track expenses and forecast financial requirements to protect against overspending. Ans: Yes, building and construction accounting professionals manage tax conformity for building and construction tasks.

Introduction to Building And Construction Audit By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building and construction firms need to make challenging options amongst lots of economic choices, like bidding on one project over an additional, selecting funding for materials or tools, or setting a job's earnings margin. Building and construction is an infamously unpredictable sector with a high failing price, slow-moving time to payment, and irregular money circulation.

Manufacturing includes repeated procedures with quickly identifiable prices. Manufacturing needs various processes, materials, and equipment with varying costs. Each job takes area in a new place with differing website problems and unique difficulties.

Everything about Pvm Accounting

Resilient relationships with vendors relieve settlements and improve efficiency. Inconsistent. Frequent usage of various specialty contractors and distributors affects efficiency and cash money circulation. No retainage. Payment gets here completely or with routine repayments for the complete agreement quantity. Retainage. Some part of settlement may be held back until project completion even when the service provider's work is completed.

While conventional manufacturers have the benefit of regulated environments and enhanced manufacturing procedures, construction firms have to regularly adjust to each brand-new task. Even somewhat repeatable tasks need modifications due to website conditions and various other factors.

Report this page